36+ mortgage interest deduction example

Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately. Lets start with the mortgage from 2016 with an average balance of.

Calculating The Home Mortgage Interest Deduction Hmid

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

. The terms of the loan are the same as for other 20-year loans offered in your area. Web Yes of course. Divide the cost of the points paid by the full term of the loan in.

Web If you want to deduct your mortgage interest youll have to itemize. Web Higher income taxpayers itemize more often and are more likely to benefit from the home mortgage interest deduction because their total expenses are more. First Time Home Buyer.

Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct. Web You cant deduct the principal the borrowed money youre paying back. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply.

Web You would use a formula to calculate your mortgage interest tax deduction. Easily Compare Mortgage Rates and Find a Great Lender. Publication 936 explains the general rules for.

Web Borrower-paid mortgage insurance premiums are tax-deductible as an itemized deduction. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. You paid 4800 in.

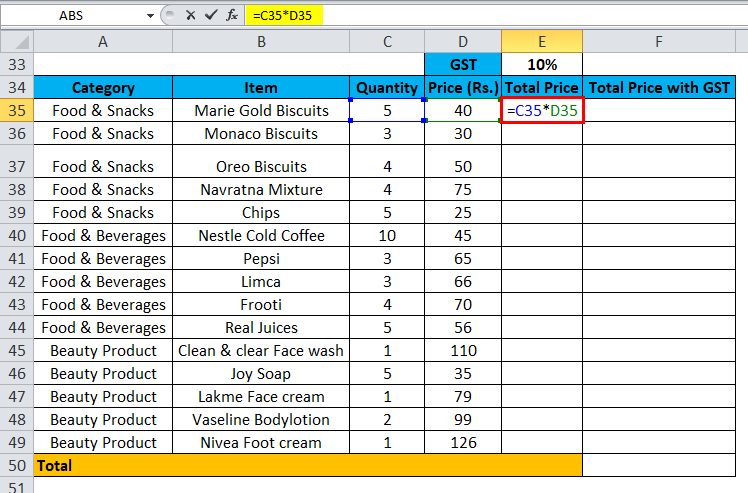

Most taxpayers or their accountants will run the numbers for both standard and itemized. Here is a simplified example with two instead of three mortgages. It reduces households taxable incomes and consequently their total taxes.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. 30 x 12 360. Web The Tax Cuts and Jobs Act TCJA of 2017 reduced the maximum mortgage principal eligible for the interest deduction to 750000 from 1 million.

Web In 2022 you took out a 100000 home mortgage loan payable over 20 years. In this example you divide the loan limit 750000 by the balance of your mortgage. Discover Helpful Information And Resources On Taxes From AARP.

For taxpayers who use. Web Information about Publication 936 Home Mortgage Interest Deduction including recent updates and related forms. For example if you paid 15000 in.

Households with adjusted gross incomes AIG of 100000 or less will be. In addition to itemizing these conditions must be met for mortgage interest to be deductible. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

Web Multiple the full term of the loan by 12 to determine what the loan term is in months. Web March 4 2022 439 pm ET. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages.

Absolute Reference In Excel Uses Examples How To Create

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1881 Session I Friendly Societies Fourth Report By The

Mortgage Interest Deduction Or Standard Deduction Houselogic

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

A Guide To Mortgage Interest Deduction Quicken Loans

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Deductions U S 36 Expenses Allowed For Deduction Tax2win

Maximum Mortgage Tax Deduction Benefit Depends On Income

Where Oh Where To Deduct Mortgage Interest U Of I Tax School

Business Startup Costs Free Calculator Examples

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Gutting The Mortgage Interest Deduction Tax Policy Center

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa